child tax credit 2021 dates

The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of families.

Dates For The Advanced Child Tax Credit Payments

Here are the official dates.

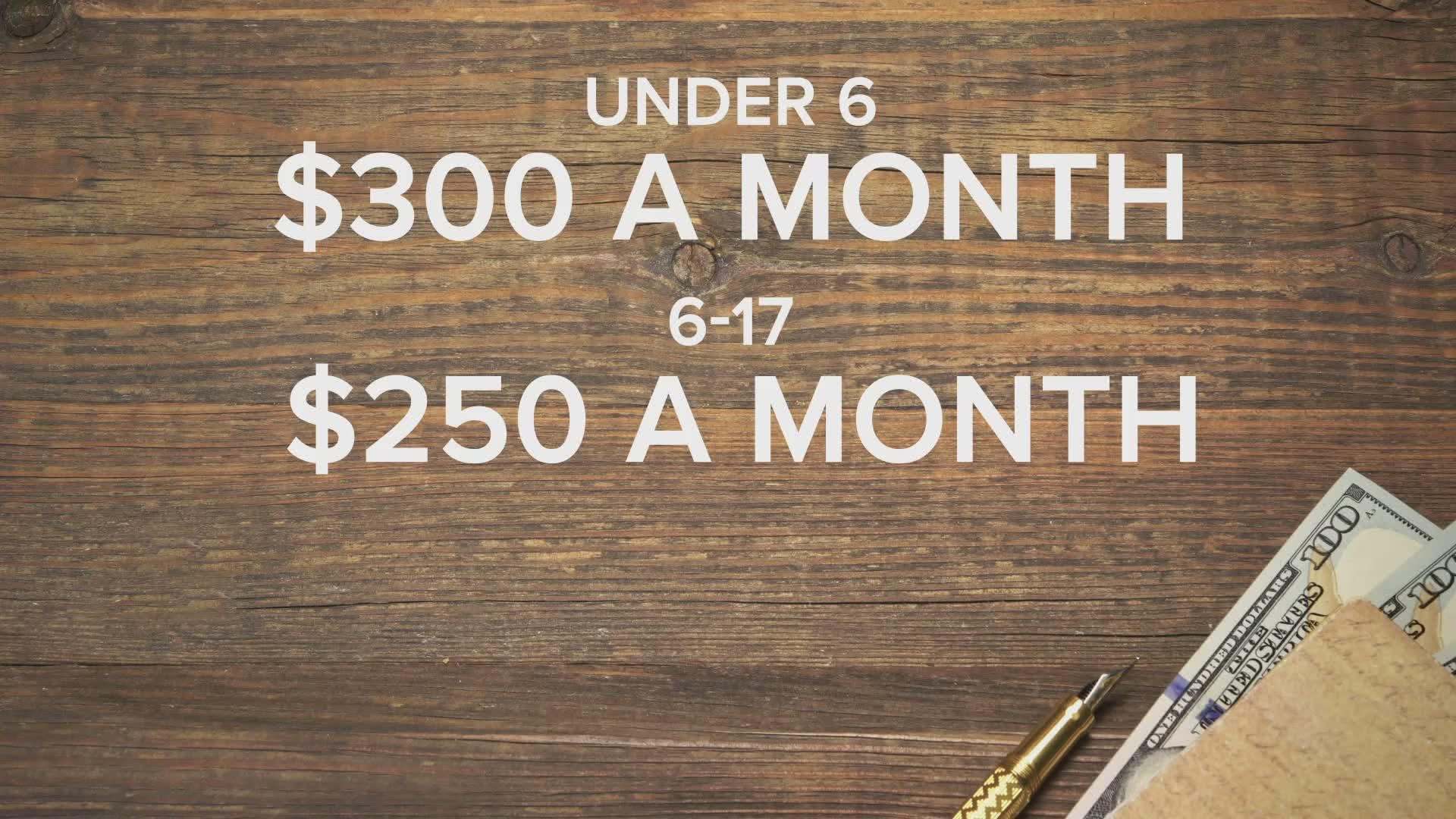

. 2021 Advance Child Tax Credit Payments start July 15 2021 Eligible families can receive advance payments of up to 300 per month for each child under age 6 and up to 250 per. Here are the child tax benefit pay dates for 2022. How Next Years Credit Could Be Different.

Advance payments of the enhanced child tax credits were sent to people from July to December 2021. Goods and services tax harmonized sales tax GSTHST credit. Households making less than 12500 and married couples making under 25000 can turn in a simplified tax return via a website the federal government built for the child tax.

New 2021 Child Tax Credit and advance payment details. The IRS pre-paid half the total credit amount in monthly payments from. Canada child benefit payment dates.

The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. However the refundability of the credit is limited similar to the 2020 Child Tax Credit and Additional Child Tax Credit. These changes apply to tax year 2021 only The.

IR-2021-153 July 15 2021 The Internal Revenue Service and the Treasury Department announced today that millions of American families have started receiving. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. Because of the COVID-19 pandemic the CTC was expanded under the American Rescue Plan of 2021.

For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. Update your direct deposit info or mailing address through the IRS portal. The CRA makes Canada child benefit CCB payments on the following dates.

Your amount changes based on the age of your. These updated FAQs were released to the public in Fact Sheet. Its usually around the 20th of the month but some dates are different for example December its a little earlier because of the.

For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to. The monthly payments were up to 250 or 300 per child for a period of. The IRS said.

The payments will be made either by direct deposit or by paper check depending on what. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors. Child Tax Credit amounts will be different for each family.

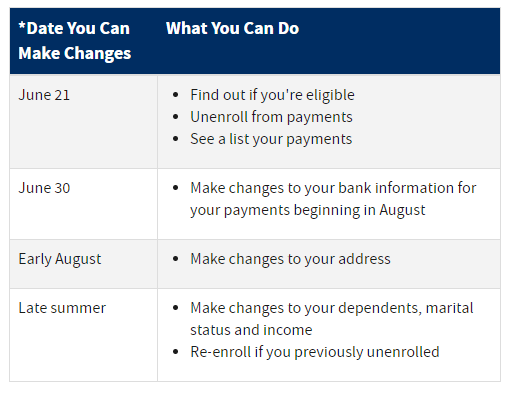

Wait 5 working days from the payment date to contact us. For more information see Q B7 in Topic B. To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates.

13 opt out by Aug. 15 opt out by Aug. Frequently asked questions about the Advance Child Tax Credit Payments in 2021 Topic A.

For 2022 that amount reverted to 2000 per child. For these families each payment is up to 300 per month for each child under age 6 and. 3600 for children ages 5 and under at the end of 2021.

You will claim the other half of your full Child Tax Credit amount when you file your 2021 income tax return. Child Tax Credit 2022. Have been a US.

Includes related provincial and territorial programs. 3000 for children ages 6.

New Child Tax Credit Explained When Will Monthly Payments Start 9news Com

Why Opting Out Of Monthly Child Tax Credit Payments May Work For Some Families Boyer Ritter Llc

Will You Have To Repay The Advanced Child Tax Credit Payments

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Tax Tip 2021 Advance Child Tax Credit Information For U S Territory Residents Tas

Child Tax Credit Payment Schedule Here S When To Expect Checks 10tv Com

Advance Payments Of The Child Tax Credit The Surly Subgroup

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Fuller Advance Child Tax Credit Payments

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

The Child Tax Credit Grows Up To Lift Millions Of Children Out Of Poverty Tax Policy Center

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

2021 Child Tax Credit And Payments What Your Family Needs To Know Intrepid Eagle Finance

/cloudfront-us-east-1.images.arcpublishing.com/gray/AZXLCRNHQ5GI7LVGR72GFTAW7M.jpg)

Child Tax Credits Causing Confusion As Filing Season Begins

Child Tax Credit Wondering About Your January Monthly Payment Silive Com

Federal Reserve Banks Share Information About Advance Child Tax Credit Payments

Child Tax Credit Eligibility Who Gets Irs Payments This Week Wwmt